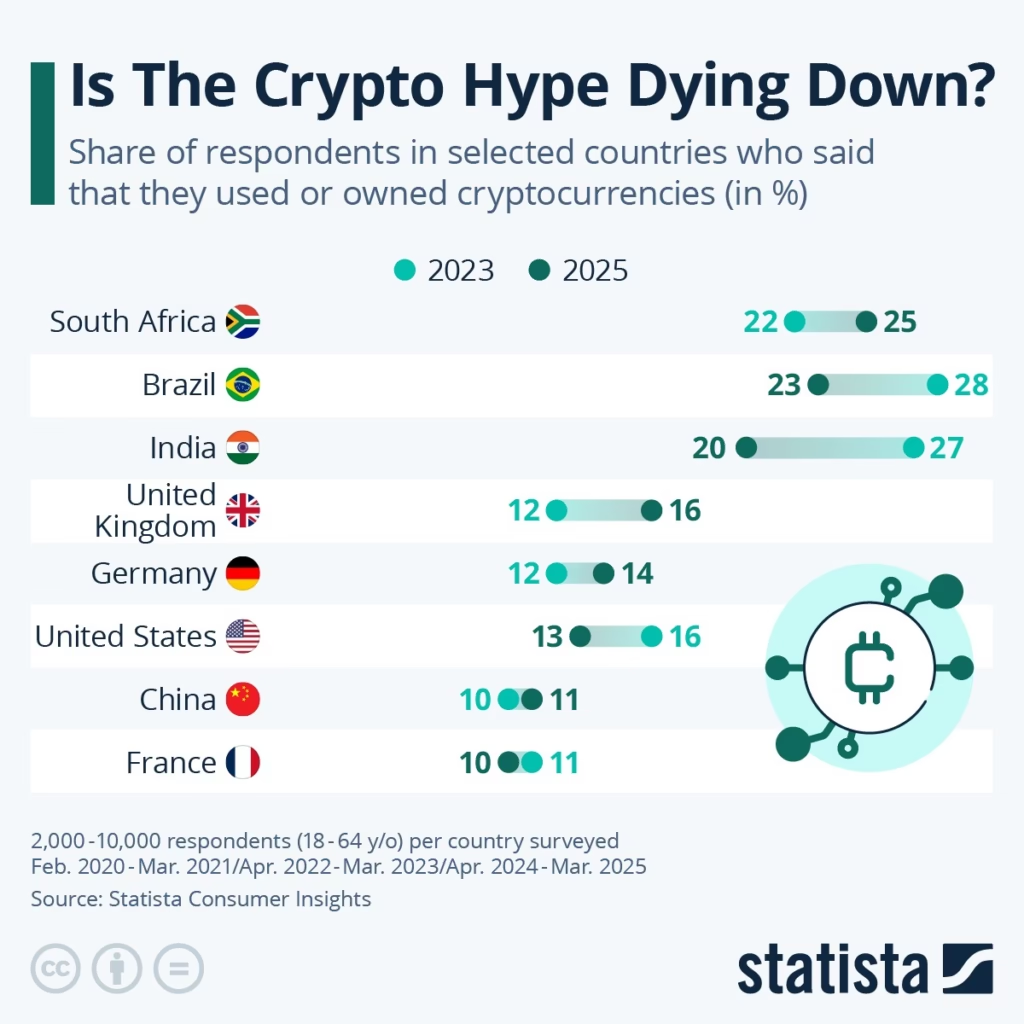

The crypto world is no longer just about hype, memes, and wild speculation. As the industry matures, a new wave of altcoins is emerging, projects that are not only technologically sound but also have real, tangible utility. These aren’t tokens that rely solely on marketing buzz; they’re solving real problems in finance, data, privacy, and beyond.

If you’re an investor, enthusiast, or just someone who’s tired of empty promises in the space, here are the top 5 altcoins to watch in 2025, each backed by a solid use case and a growing ecosystem.

1. Chainlink (LINK): Powering Real-World Data for Smart Contracts

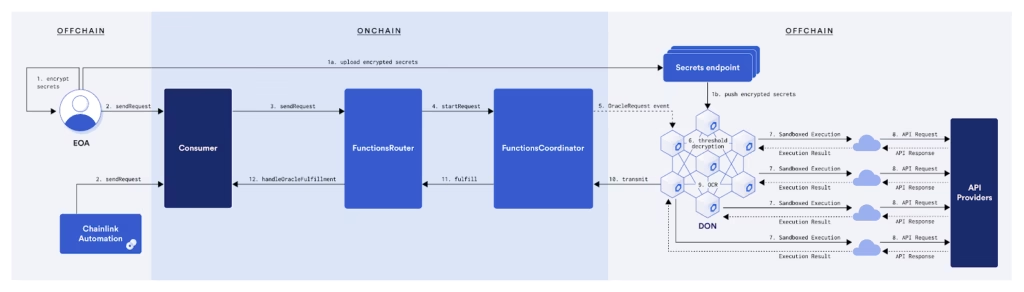

Smart contracts are only as good as the data they’re built on. That’s where Chainlink comes in. It bridges the gap between blockchain and the real world by providing decentralized oracles, essentially, trusted data feeds.

From DeFi protocols needing accurate price feeds to insurance platforms requiring weather data, Chainlink has become the backbone of blockchain-based automation. Over 1,600 projects already integrate Chainlink in some form, and its continued expansion into real-world asset tokenization and Proof of Reserve services make it a no-brainer for long-term potential.

Use Case: Reliable, decentralized data for smart contracts

Why it matters: Without oracles like Chainlink, DeFi doesn’t work. Period.

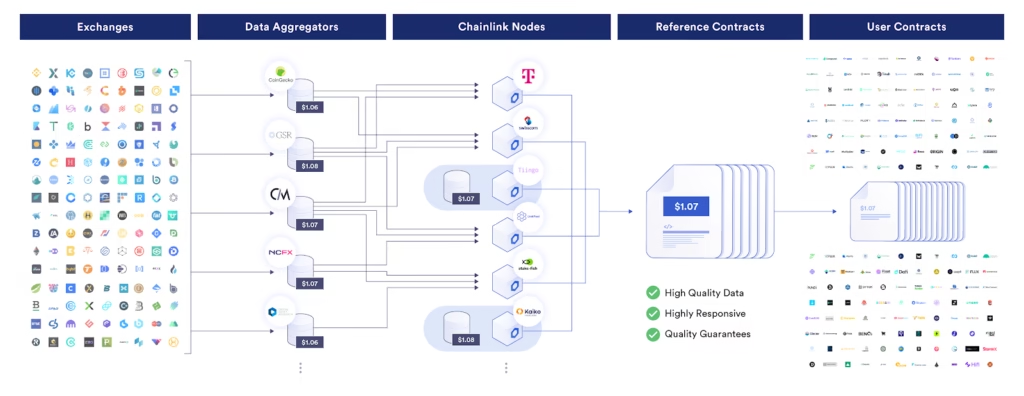

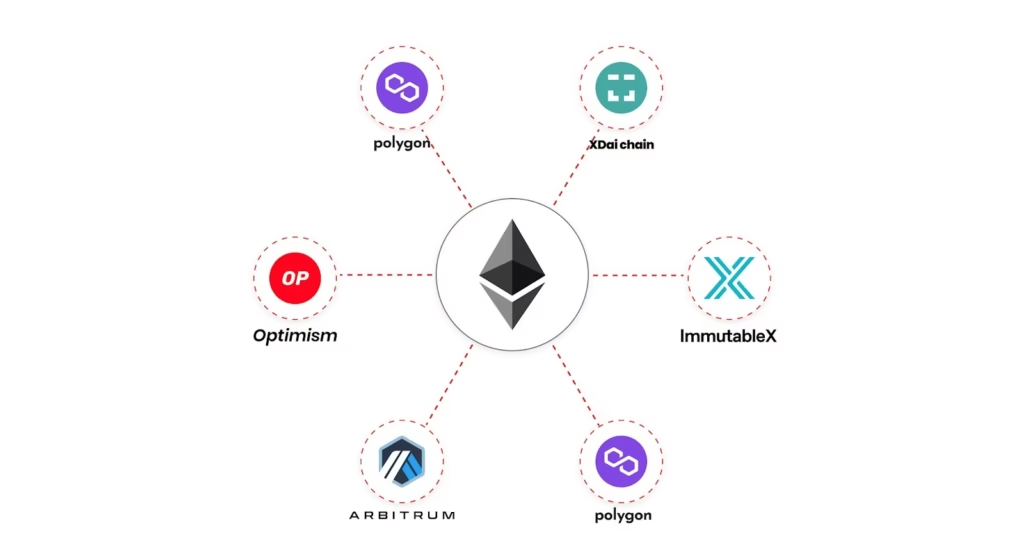

2. Arbitrum (ARB): Scaling Ethereum Without Sacrificing Security

Ethereum is the undisputed king of smart contracts, but it’s not without flaws; namely, high fees and network congestion. Enter Arbitrum, a leading Layer 2 scaling solution that helps Ethereum do more with less.

By processing transactions off-chain and settling them back to Ethereum, Arbitrum offers significantly faster speeds and lower costs while maintaining Ethereum’s security guarantees. Major DeFi apps like Uniswap, Aave, and GMX are already live on it.

Use Case: Scaling Ethereum via rollups

Why it matters: Ethereum isn’t going anywhere. Arbitrum helps it stay usable.

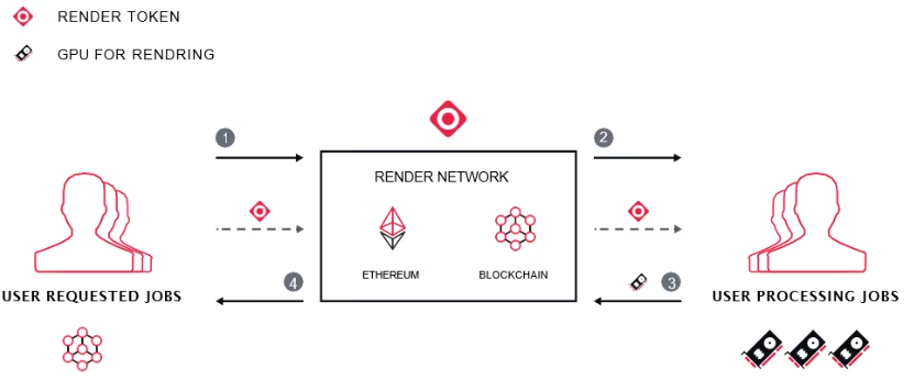

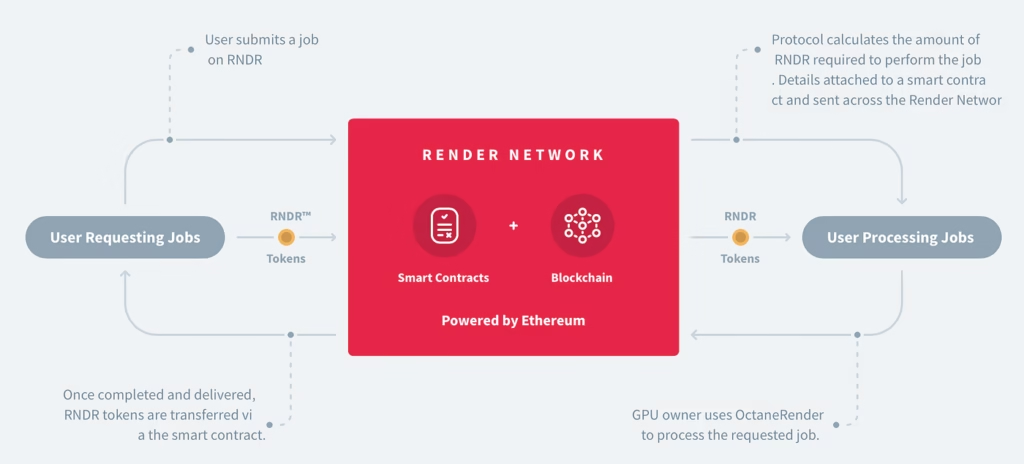

3. Render (RNDR): Decentralized Graphics Power

The metaverse, gaming, AI, and virtual production all rely on one critical component: rendering power. Traditional rendering farms are expensive and centralized. Render Network changes that by distributing rendering jobs to idle GPUs around the world.

This isn’t speculative infrastructure, Render already powers real production pipelines for creators and studios.

Use Case: Decentralized rendering for digital media

Why it matters: Render plugs blockchain directly into the digital content economy.

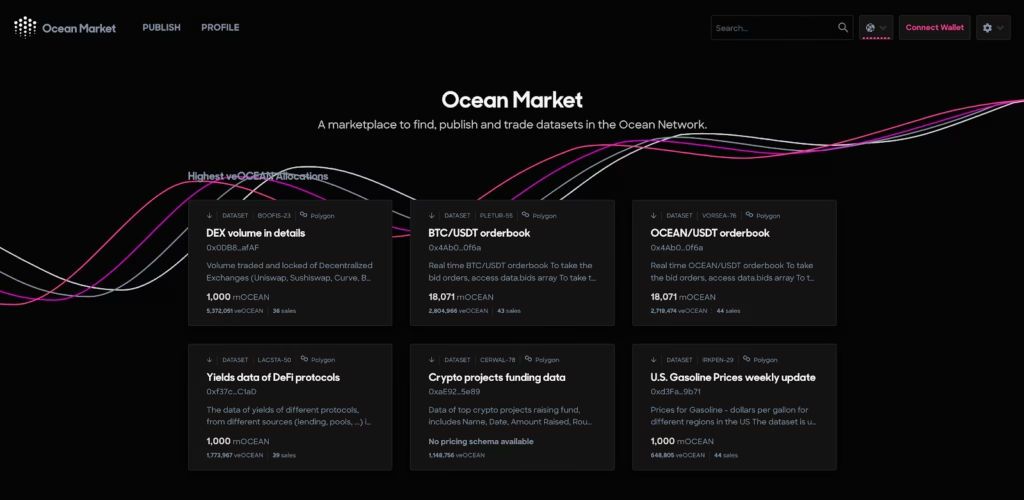

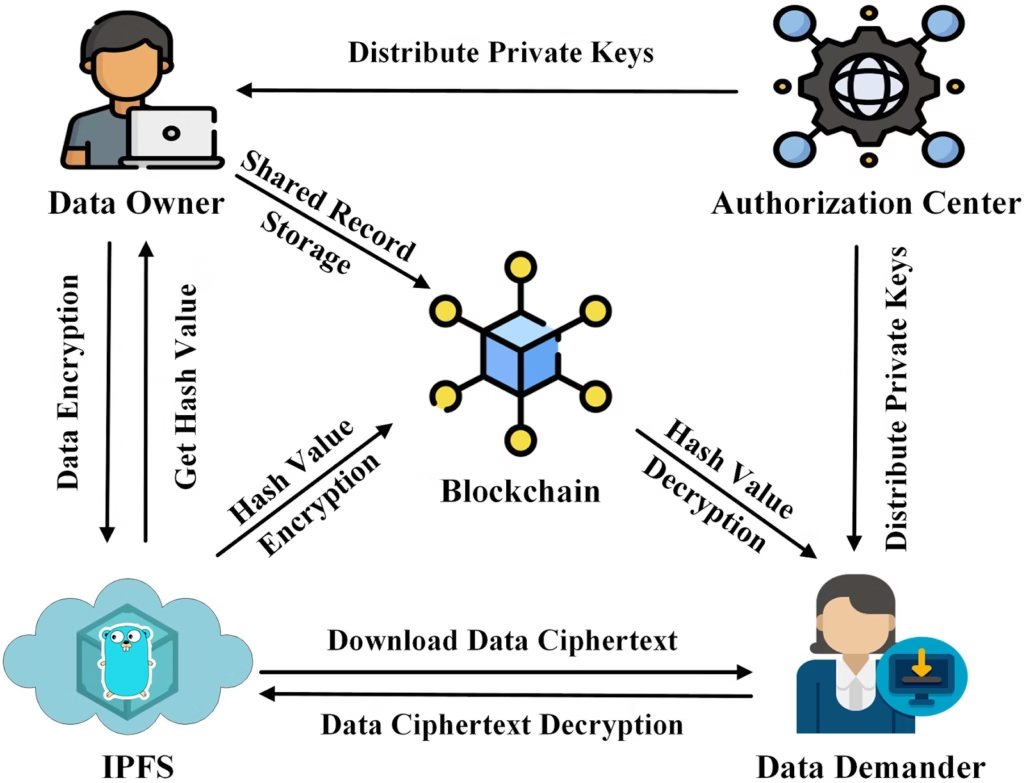

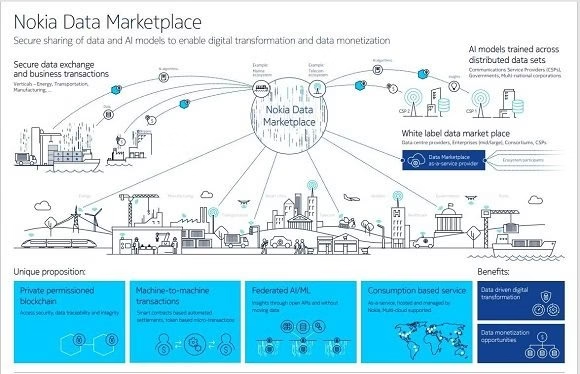

4. Ocean Protocol (OCEAN): Monetizing Data Securely

In today’s economy, data is currency, yet most individuals and smaller enterprises have no way to monetize their own. Ocean Protocol enables secure data sharing and monetization without handing control to centralized intermediaries.

As AI demand explodes, access to clean and permissioned datasets becomes critical. Ocean is positioned right at that intersection.

Use Case: Decentralized marketplace for data sharing and monetization

Why it matters: Ocean gives individuals and organizations ownership over their data.

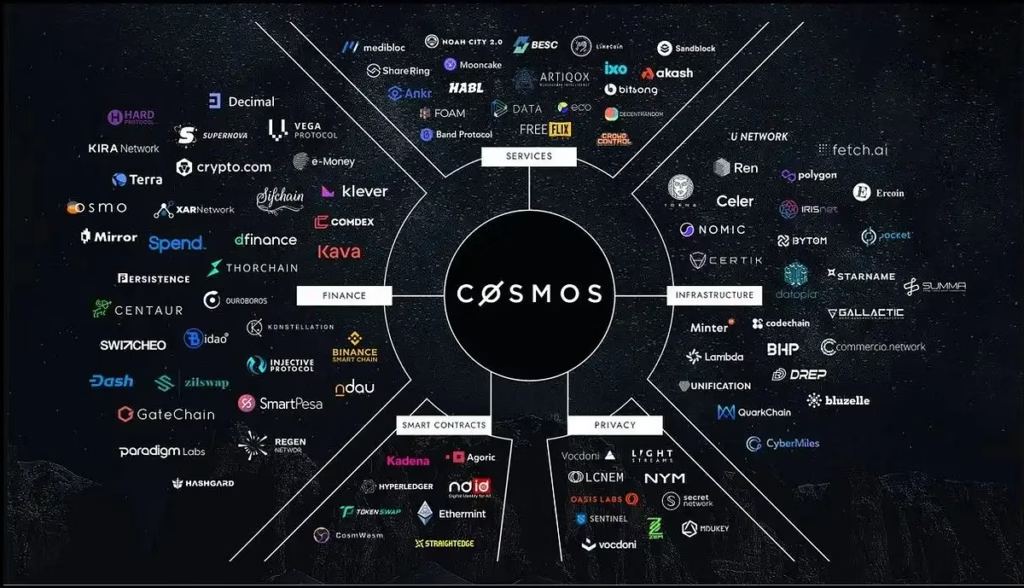

5. Kujira (KUJI): Bringing Institutional Tools to the Average Investor

Kujira focuses on something crypto often ignores: usability. It delivers liquidation markets, yield tools, and stablecoin infrastructure that normally only institutions can access, now available to everyday users.

Its steady expansion across Cosmos chains positions it as a quiet but serious DeFi contender.

Use Case: Democratized access to advanced financial tools

Why it matters: DeFi only wins if it includes non-whales.

Why Real-World Use Cases Matter More Than Ever

It’s no longer enough for a crypto project to have a whitepaper and a loud community. Survivors in 2025 will be projects with:

- Working products

- Paying users

- Sustainable demand

These five altcoins are grounded in utility, not hope.

Conclusion

2025 won’t be the year of blind speculation. It will be the year where infrastructure, data, scalability, and usability define winners.

These five altcoins aren’t guaranteed moonshots, but they are built to last, and that’s far rarer.

Real technology.

Real adoption.

Real reasons to believe.

Related Articles

- Cryptocurrency 101: a beginner’s guide to how digital money really works

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- Beginner’s guide: how to earn real passive income from DeFi lending without blowing up your capital

- 10 common crypto scams and exactly how to avoid losing your money to them

- DeFi explained: how decentralized finance is reshaping the future of money and traditional banking

- Ethereum vs Solana: which smart contract platform really wins on speed, cost, and ecosystem strength?