How Next-Gen Base Layers Are Redesigning Trust, UX, and Economic Incentives

Blockchain conversations used to fixate on raw speed and marketing benchmarks. That era is passing. In 2025, a new generation of Layer 1 chains is proving that architecture, composability, and incentive alignment matter more than bragging rights about TPS. This piece walks through five L1s Aptos, Sui, Celestia, Sei, Berachain and for each, shows what they actually change for builders, users, and token economics.

1) Aptos: defensive engineering, predictable UX

(short anecdote → technical unpack → production implication)

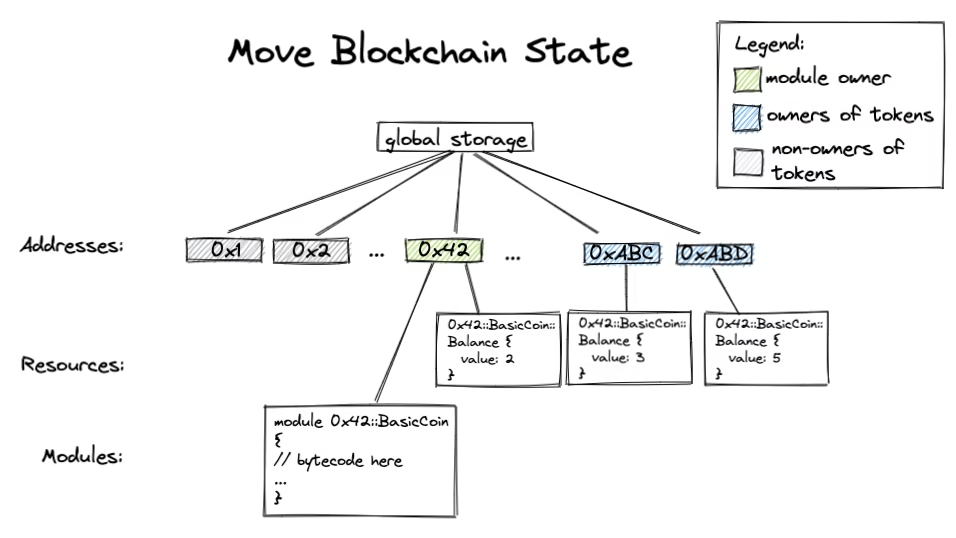

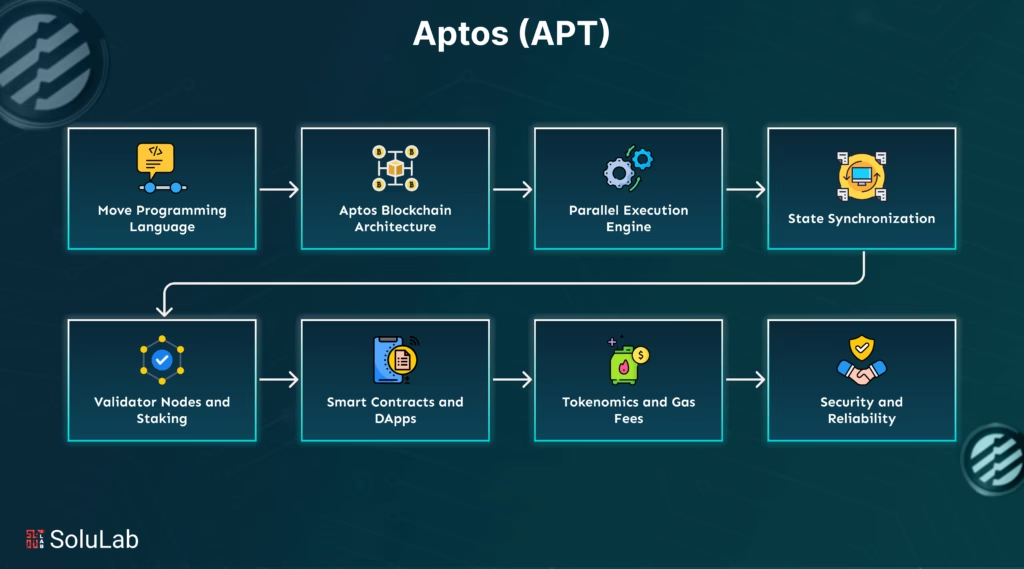

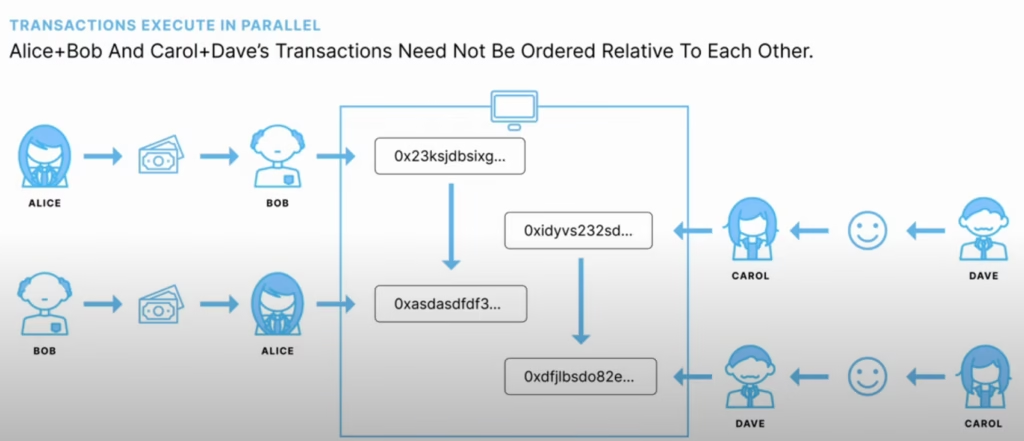

A small South Korean gaming studio I spoke with last quarter chose Aptos because their players’ wallets were not supposed to fail mid-match. That’s a telling practical criterion: Aptos sells predictability. Its Move language (inherited from Diem) is deliberately strict about resource handling, which prevents entire classes of bugs at the language level rather than relying on audits alone. Technically, Aptos uses parallel execution and deterministic state sharding so transactions that don’t touch the same resources can run concurrently. Practically, that produces predictable fees and fewer failed TXs during spikes, a UX win for consumer apps.

- Deep detail: Move’s resource types prevent accidental duplication and make ownership explicit; audits become more tractable and certain exploit vectors (e.g., rogue minting) are structurally harder to create.

- Trade–off: move toward engineering safety can require stricter developer discipline and a smaller library of prebuilt composables than an older EVM ecosystem.

2) Sui: object-centric execution that rethinks state

(concept intro → one concrete example → developer implications)

Sui treats in-chain data as objects (things with identity and mutable state), not just ledger entries. Imagine each NFT, each in-game sword, each social post as a discrete object with its own lifecycle. That enables fine-grained parallelism: two users manipulating unrelated objects don’t block one another. For games and social apps where thousands of small state changes happen per second, this is critical.

- Concrete case: a multiplayer game where item upgrades, trades, and combat moves are independent objects, finality is sub-second and gas friction disappears for routine actions.

- Developer angle: object semantics let teams express complex ownership rules directly in the runtime instead of constructing brittle contract orchestration layers.

Sui’s downsides are subtle: the object model requires rethinking contract patterns (porting from Solidity isn’t one-to-one), and composability assumptions differ (object vs. account-centered composition).

3) Celestia: modularity as a philosophical pivot

(declarative thesis → how it works → ecosystem effect)

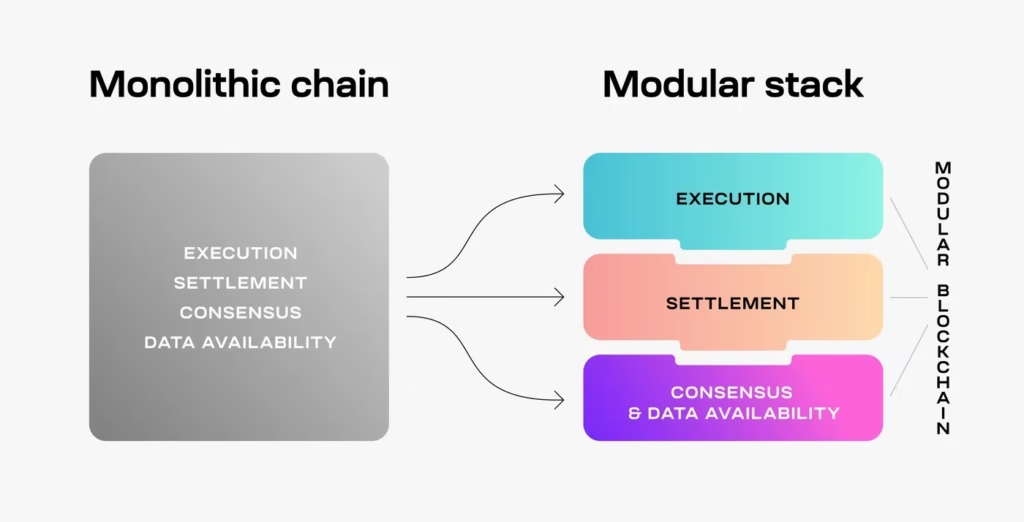

Celestia’s radical claim: stop forcing every chain to do everything. Instead of bundling execution, consensus, and data availability into a monolith, Celestia specializes in data availability & consensus, enabling any team to deploy sovereign rollups that inherit credible availability guarantees without bootstrapping a full L1.

- How it works in plain terms: rollups post their data to Celestia for availability proofs while running execution logic off-chain or on specialized execution layers. Celestia validates that the data is accessible to the network, which is enough for fraud proofs or data-availability sampling schemes.

- Ecosystem result: dramatically cheaper and faster bespoke chains for use cases that don’t need global settlement every second (e.g., bespoke gaming chains, private enterprise ledgers with public data availability).

This modular model changes unit economics: launching sovereign execution environments becomes faster and cheaper, and developers can choose the exact trade-off between latency, security, and cost. The risk: tooling complexity increases and cross-rollup composability needs new primitives.

4) Sei: when a chain is built for trading

(problem statement → engineering choices → market consequences)

Sei’s thesis is focused: the performance characteristics traders need (low-latency, deterministic ordering, low slippage) are different from general-purpose dApp needs. Rather than retrofit AMM logic, Sei designs its mempool, consensus, and order matching to minimize MEV and provide predictable execution for limit orders and order-book styles.

- Engineering specifics: specialized transaction routing, parallelized order matching, and deterministic settlement windows reduce front-running opportunities and lower effective slippage for on-chain traders.

- Market consequence: as centralized exchanges face regulatory headwinds, chains like Sei can attract professional liquidity providers who demand near-CEX speeds with on-chain custody.

If you’re building a DEX that must compete with off-chain latency, Sei presents a qualitatively different base layer.

5) Berachain: aligning validator incentives with real liquidity

(conceptual pitch → mechanism → systemic effects)

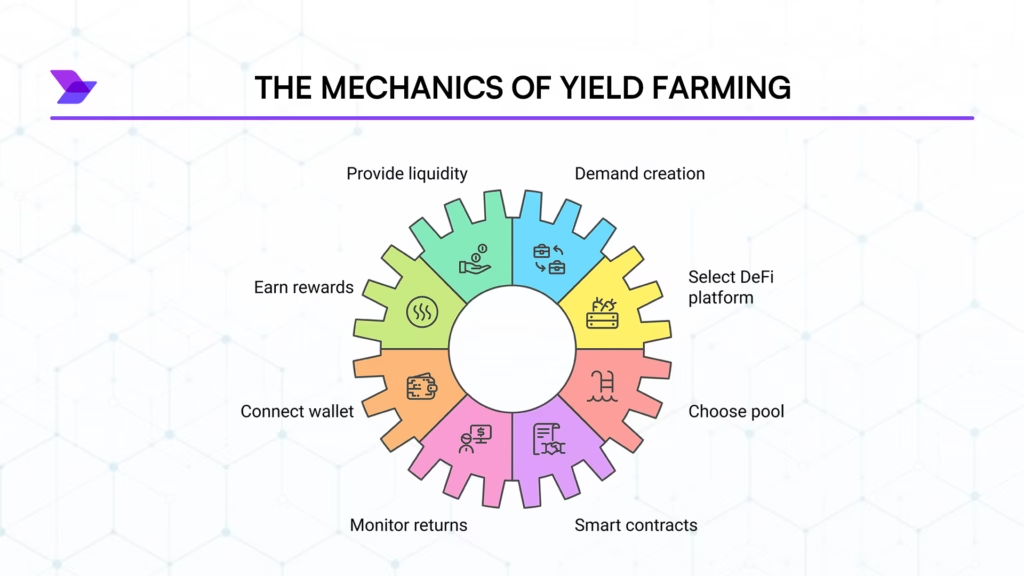

Berachain flips a design question: what if validator security requires providing active liquidity? Under Proof-of-Liquidity, validators must lock capital into on-chain markets to participate. The result is validator capital that’s not idle: it underpins DEXes, lending pools, and native market depth.

Mechanism: staking is replaced or augmented with liquidity commitments; consensus weight correlates with usable protocol liquidity (not just token stake).

Systemic effects: better liquidity retention, lower barriers for dApps relying on native liquidity, and less mercenary capital flight because validator returns are connected to real economic throughput.

Risks are present: tying consensus to market positions could magnify systemic shocks in crises (e.g., forced deleveraging). Governance and slashing models must be carefully engineered to avoid cascading liquidation across consensus.

Cross-chain composability, developer ergonomics, and tooling

(bullet list with action items for architects & teams)

- Security primitives: prefer languages/runtime features that enforce resource invariants (e.g., Move) for assets and tokens.

- Composability layers: if you need cross-rollup composability, choose L1s or DA layers with standardized DA and bridging primitives.

- Latency needs: match application class to chain, sub-second interactive UX → Sui/Aptos; trading/orderbook → Sei; bespoke sovereign chains → Celestia rollups.

- Incentive design: if your dApp relies on endogenous liquidity, place it where validator economics support that (Berachain-style).

- Tooling maturity: check SDKs, debugging tooling, and explorer quality, these are the true bottlenecks on developer velocity.

How to think about risk and adoption

(analytical paragraph + table summary)

Each L1 solves a different failure-mode. Aptos mitigates contract-level exploits via language design; Sui reduces UX friction for consumer apps; Celestia reduces launch friction for sovereign rollups; Sei targets market microstructure; Berachain aligns liquidity incentives. Investors should map exposure across functional risk (security, composability), adoption risk (developer activity, real users), and economic risk (tokenomics, validator behavior).

| Chain | Primary Use Case | Key Risk | Adoption Signal |

| Aptos | Consumer apps, fintech | Developer tooling depth | Growing gaming/fintech pilots |

| Sui | Interactive dApps, gaming | Porting complexity | Fast UX-centric adoption |

| Celestia | Rollups / sovereign chains | Tooling & bridging | Increasing rollup launches |

| Sei | Trading / orderbooks | Liquidity concentration | High DEX volume, LP retention |

| Berachain | Liquidity-centric DeFi | Liquidations systemic risk | Sticky native liquidity metrics |

Regulation, real-world rails, and deployment geography

(mini-essay style paragraph)

Layer 1s that win in 2025 are those that work with real rails: fiat on/off ramps, compliance-friendly custody options, and regional partnerships. Chains optimized for micropayments and low-fee UX are gaining adoption in Asia, Africa, and LATAM where remittances and mobile-first use cases dominate. Conversely, trading-focused L1s must reconcile AML/KYC expectations for institutional LPs. The interplay between protocol design and regulatory posture is now a first-order strategic variable, not a footnote.

Closing synthesis: pick problems, not buzzwords

The next decade of blockchain is not one where a single L1 swallows all others. It’s a modular web where purpose-built base layers coexist, connected by data availability, bridges, and composability standards. Aptos and Sui bring UX and execution innovations; Celestia offers a new building block for rollups; Sei brings institutional-grade trading primitives on-chain; Berachain reimagines validator incentives to bootstrap real liquidity. Each design contains subtle trade-offs, scalability vs. composability, validator alignment vs. systemic stress, language safety vs. library richness.

If you build or invest in 2025, your decision should start with the application constraint (what does your app actually need?), then flow into architectural fit, developer ecosystem, and economic alignment. Technical specs are only meaningful when mapped to a clear, realistic use case.

Related Articles

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- Beginner’s guide: how to earn real passive income from DeFi lending without blowing up your capital

- How to build a balanced crypto portfolio that works in both brutal bear phases and euphoric bull runs (2025 blueprint)

- Ultimate 2025 guide: how to protect your seed phrase from theft, fire, and family members

- Web3 decoded: what it is, why it matters, and how you can start participating today