Stablecoins have quietly become the operating system of crypto.

In 2025, they are no longer just parking spots during volatility, they are the medium through which liquidity moves, yield is generated, payments settle, and on-chain economies function.

Every major crypto workflow- DeFi lending, perpetual trading, cross-border remittances, Layer 2 activity, RWAs, even Web3 payroll, now relies on stablecoins as its base layer. With total supply pushing past $200 billion, stablecoins have effectively become the shadow dollar system of the internet. Yet this growth has not produced a single winner. Instead, the market has fractured along design philosophy lines:

compliance vs sovereignty, fiat backing vs synthetic exposure, simplicity vs capital efficiency.

Understanding stablecoins in 2025 means understanding why multiple models coexist, and where each one fits.

Why Stablecoins Still Sit at the Center of Crypto

Despite improved market maturity, stablecoins remain indispensable because they solve problems that no volatile asset can:

They preserve purchasing power without forcing users back into banks, provide deep liquidity across centralized and decentralized venues, move frictionlessly across chains and Layer 2s, and act as the primary unit of account in DeFi. More subtly, stablecoins are now policy tools. Protocols use them to manage risk, governments regulate them to control rails, and institutions deploy them as programmable cash equivalents.

In other words: stablecoins are no longer a feature of crypto, they are its foundation.

USDT: Liquidity as a Network Effect

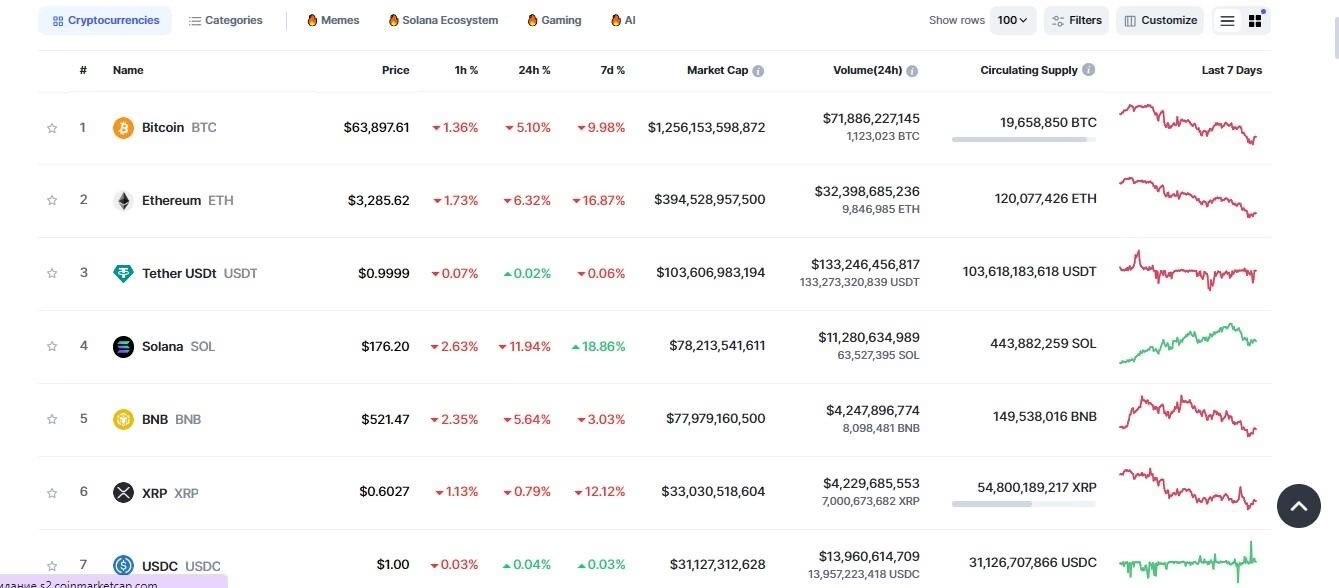

Tether’s USDT remains the most dominant stablecoin in 2025, not because it is perfect, but because it is everywhere. With circulation exceeding $115 billion, USDT functions as crypto’s global settlement currency particularly outside Western banking systems. In emerging markets where access to USD banking is restricted, USDT is often more liquid than local currency.

USDT’s strength lies in:

- unmatched exchange pair dominance,

- deep integration across Tron, Ethereum, Solana, and Layer 2s,

- and sheer transactional velocity.

Transparency concerns still exist, but markets have effectively priced that risk in. During multiple stress events, USDT maintained its peg when liquidity mattered most cementing its role as crypto’s default trading rail. USDT is not optimized for regulation. It is optimized for usage.

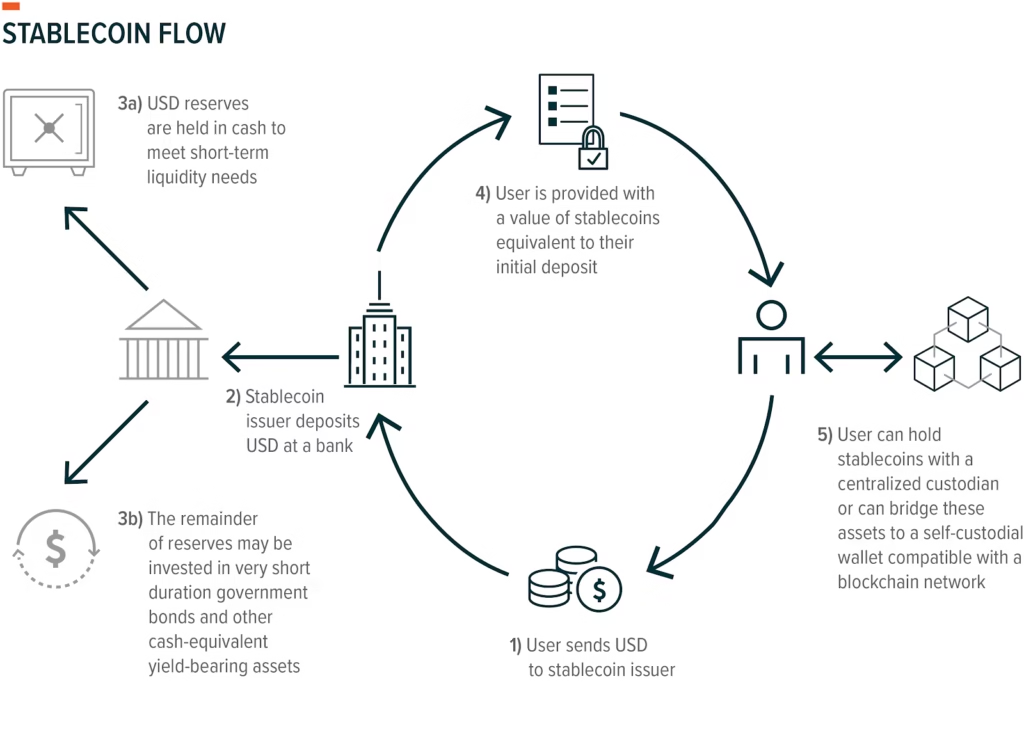

USDC: Stablecoins as Financial Infrastructure

USDC represents the opposite philosophy. Issued by Circle, it is designed to integrate seamlessly with regulated finance.

Fully backed by cash and short-term Treasuries, USDC has become the stablecoin of choice for institutions, fintechs, and compliant DeFi environments. In 2025, it underpins payment rails, on-ramps, and corporate crypto workflows.

Its biggest evolution has been native interoperability.

Circle’s Cross-Chain Transfer Protocol allows USDC to move between chains without traditional bridges, reducing risk and fragmentation.

USDC excels where:

- regulatory clarity matters,

- fiat redemption is essential,

- and institutional capital is involved.

It may not dominate speculative trading like USDT, but it increasingly dominates real-world crypto finance.

DAI: Decentralization, Compromised but Not Abandoned

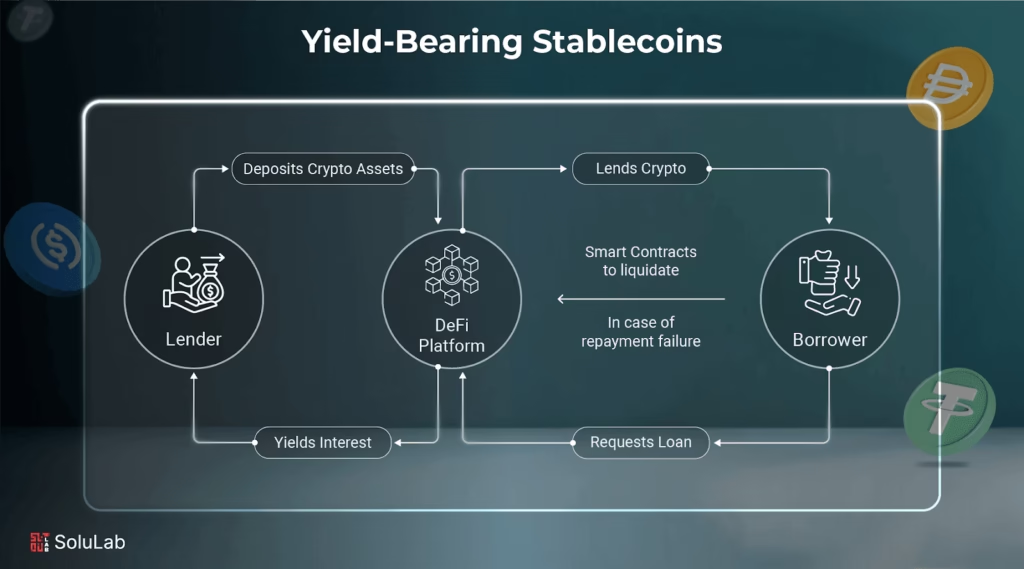

DAI remains crypto’s most influential decentralized stablecoin not because of size, but because of architecture. Once purely crypto-collateralized, DAI has evolved into a hybrid monetary system. MakerDAO now blends ETH-based collateral with tokenized real-world assets such as Treasury exposure. This shift allows DAI to generate sustainable yield while preserving on-chain governance.

DAI’s relevance comes from:

- deep DeFi composability,

- censorship resistance relative to fiat-backed peers,

- and integration into lending, RWAs, and DAO treasuries.

At roughly $6 billion in supply, DAI is smaller, but structurally critical. It proves that decentralization can adapt without disappearing.

FRAX: Capital Efficiency as a Design Principle

FRAX represents the most successful evolution of algorithmic stablecoins to date.

Rather than relying on fragile reflexive mechanics, FRAX combines partial collateralization with protocol-owned liquidity and revenue-generating primitives. Its ecosystem, spanning lending, AMMs, and ETH staking derivatives, creates internal demand and stabilizing pressure.

FRAX works because:

- it is flexible rather than dogmatic,

- its peg management adapts to market conditions,

- and it rewards users for participation, not speculation.

Among advanced DeFi users, FRAX is less a “stablecoin” and more a yield-bearing monetary system.

The New Generation: Stablecoins With Purpose

2025 has introduced stablecoins that no longer aim to be universal, they aim to be specific.

PYUSD focuses on consumer payments and ecommerce.

USDM packages Treasury yield directly into the stablecoin itself.

USDe uses delta-neutral ETH exposure to maintain its peg without fiat custody.

GHO embeds stablecoin issuance directly into protocol governance.

These designs reflect a broader shift: stablecoins are becoming application-aware, not just value-pegged.

Stablecoins Live on Layer 2 Now

The center of gravity has moved. Most stablecoin volume now flows through Layer 2 networks, not Ethereum mainnet.

Lower fees, faster settlement, and better UX have made Arbitrum, Optimism, Base, and zkSync the default venues for stablecoin-based activity. Liquidity pools, lending markets, and synthetic protocols increasingly launch L2-first. Stablecoins are no longer just chain-agnostic, they are execution-optimized.

Regulation Has Split the Market in Two

By 2025, regulation no longer threatens stablecoins, it defines them. The market has cleanly separated into:

- regulated, fiat-backed instruments optimized for compliance and scale,

- decentralized and synthetic models optimized for sovereignty and yield.

Neither side is winning. Both are necessary. This duality mirrors the broader crypto economy itself.

Choosing the Right Stablecoin Is Strategic

There is no “best” stablecoin, only best for a given objective. Liquidity, compliance, yield, censorship resistance, and ecosystem alignment all pull in different directions. Sophisticated users diversify across models, chains, and issuers.

In 2025, stablecoin choice is not passive, it is part of portfolio construction.

Stablecoins of 2025- Comparative Snapshot

| Stablecoin | Model | Primary Strength | Best Use Case |

| USDT | Centralized | Deepest liquidity | Global trading, CEXs |

| USDC | Regulated | Compliance, fiat rails | Institutions, payments |

| DAI | Decentralized hybrid | DeFi composability | Lending, RWAs |

| FRAX | Algo-hybrid | Capital efficiency | Yield strategies |

| USDe | Synthetic | Delta-neutral design | Advanced trading |

| PYUSD | Fiat-backed | Consumer payments | Retail, ecommerce |

| USDM | Yield-bearing | Treasury exposure | Institutional DeFi |

| GHO | Protocol-native | User-owned issuance | Aave ecosystem |

Final Perspective

Stablecoins are no longer accessories to crypto, they are its monetary engine. As regulation hardens, Layer 2s scale, and real-world assets come on-chain, stablecoins will increasingly define who can participate, how value moves, and what kind of financial system crypto becomes. In 2025, understanding stablecoins is not optional.

It is the difference between using crypto and navigating it intelligently.

Related Articles

- How to safely buy Bitcoin in 2025: a complete beginner’s roadmap with pro-level

- How real‑world assets (RWAs) on-chain are becoming crypto’s next trillion‑dollar narrative

- How to build a balanced crypto portfolio that works in both brutal bear phases and euphoric bull runs (2025 blueprint)

- Top 5 emerging Layer‑1 blockchains to watch closely in 2025

- Ultimate 2025 guide: how to protect your seed phrase from theft, fire, and family members

- Best Layer‑2 networks in 2025: Arbitrum, Optimism, zkSync and how they really compare