A clear expert guide to what cryptocurrencies are, how blockchain works, reasons people invest, major risks, and practical, safety-first strategies for anyone considering crypto.

Why has cryptocurrency attracted so much attention?

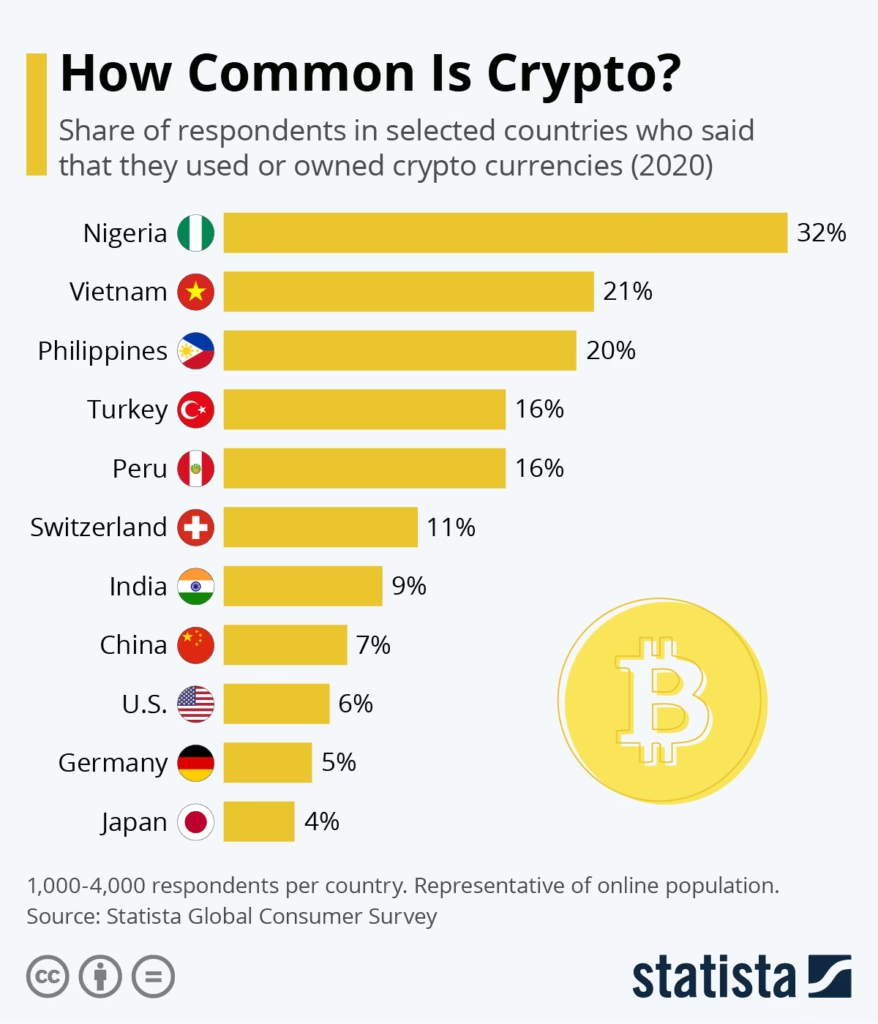

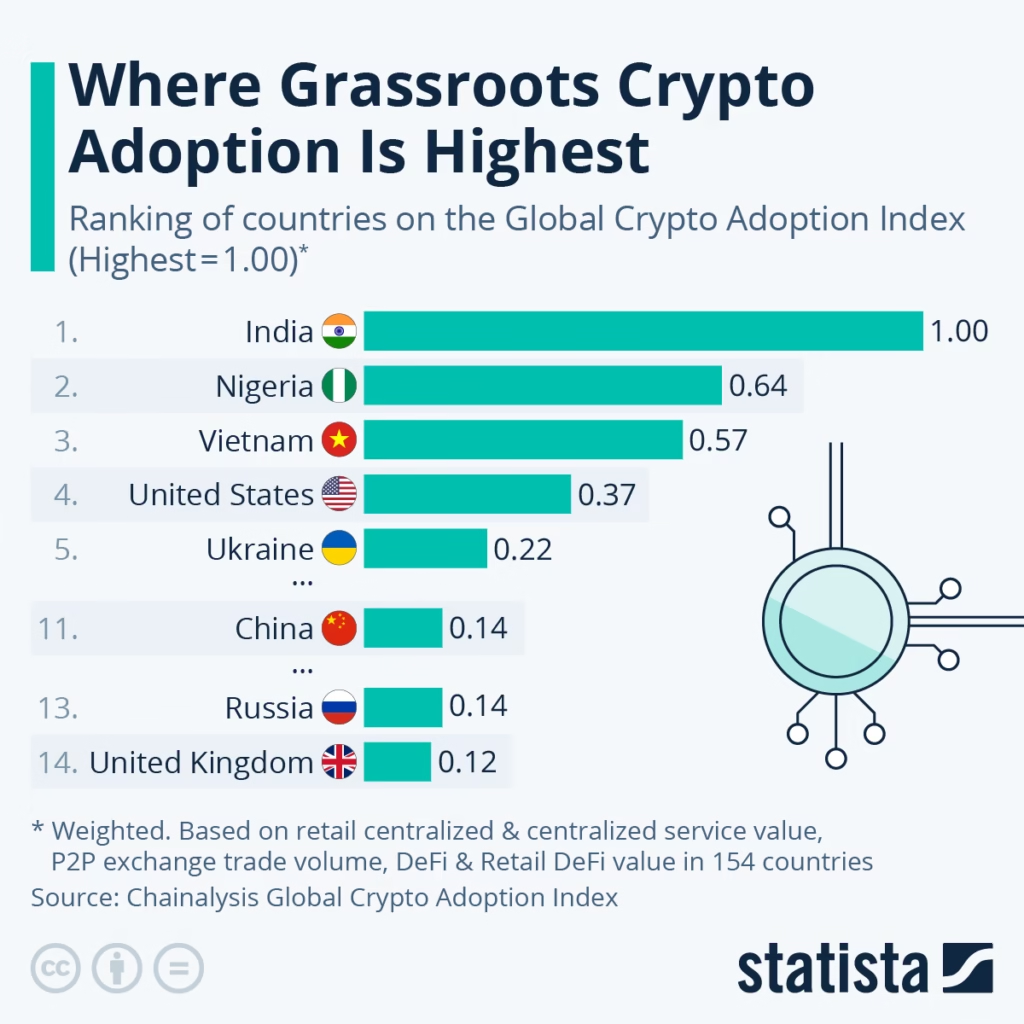

Traditional investments like stocks, bonds, and ETFs remain the backbone of most portfolios. Yet cryptocurrencies such as Bitcoin and Ethereum have drawn millions of investors worldwide. The reason is simple: crypto combines technology, speculation, and financial freedom in a way no prior asset class has.

Prices can rise dramatically in short periods, offering eye-catching returns. At the same time, sharp crashes are common. This dual nature raises a key question: is crypto merely speculative trading, or does it represent a lasting shift in finance? The answer lies somewhere in between.

Why people consider crypto

Investors, tech optimists and financially excluded users converge on crypto for three reasons:

- Potential returns: some tokens have delivered large gains, attracting speculative flows.

- New functionality: programmable money, smart contracts, and tokenised assets unlock new financial products.

- Access & convenience: in some contexts crypto enables quick, low-cost cross-border transfers or basic financial services where banks are missing.

That mix explains why interest is strong, but it also explains why risks are concentrated.

What is cryptocurrency?

Cryptocurrencies are digital tokens that exist only online. They allow people to send value directly to one another without banks or payment processors acting as intermediaries. Ownership is determined by cryptographic keys rather than names or account numbers.

Unlike national currencies, cryptocurrencies:

- Are not legal tender in most countries

- Have no intrinsic or legislated value

- Derive value purely from market demand and supply

Bitcoin and Ether are the most widely known, but thousands of cryptocurrencies exist, each with different goals and designs.

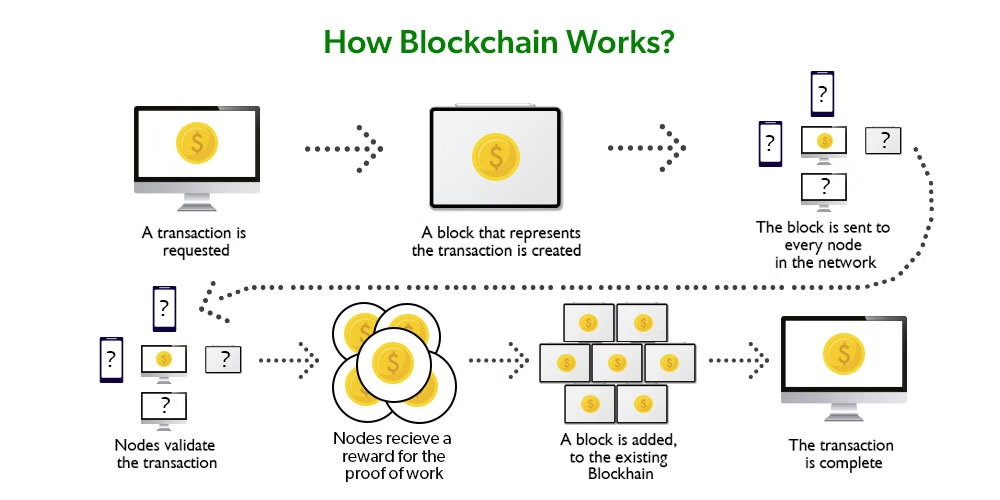

The technology in plain language

Blockchain is an append only ledger where transactions are grouped into blocks that link to earlier blocks, creating a tamper-resistant chain. Key features:

- Decentralisation: many nodes maintain copies of the ledger.

- Immutability: once validated, entries are hard to change.

- Transparency: history is auditable (on public chains).

These properties enable transfers without central intermediaries and allow programmable logic via smart contracts.

The foundation: blockchain technology

Blockchain is the underlying system that makes cryptocurrencies possible. It is best understood as a shared digital ledger maintained by thousands of computers worldwide.

Every transaction is recorded in a “block.” Each new block links to the previous one, forming a chain that is extremely difficult to alter. Once recorded, transactions are effectively permanent.

- Decentralisation: No single authority controls the system

- Security: Tampering with records is extremely difficult

- Transparency: Anyone can verify transactions on public blockchain

This architecture removes the need for trusted intermediaries and opens the door to faster, more transparent financial systems.

Why volatility matters

Crypto markets are notably volatile. That volatility offers upside but also risks: large, rapid drawdowns can erase gains and liquidate leveraged traders. The result is that many investors use crypto as a small, tactical slice of a broader portfolio rather than core savings.

Practical risk checklist

| Rule | How to implement | Why it matters |

| Allocation limit | Set a small discretionary % of portfolio (e.g., 1–5%) | Protect core capital |

| Dollar-cost averaging (DCA) | Buy fixed dollar amounts regularly | Avoid timing mistakes |

| Custody | Use hardware wallets for long-term holdings | Reduce counterparty risk |

| Research | Read whitepapers, audit reports, team history | Avoid hype-only projects |

| Exit rules | Predefine profit-taking & stop-loss levels | Prevent emotional trading |

| Tax records | Log transactions and keep receipts | Meet compliance requirements |

Quick asset comparison (publish-ready table)

| Asset | Governance | Typical volatility | Legal status |

| Cryptocurrency | Often decentralised | High | Generally not legal tender |

| Fiat currency | Central bank governed | Low (policy-managed) | Legal tender |

| Stocks / ETFs | Exchange regulated | Moderate | Financial securities |

Common mistakes to avoid

- Chasing FOMO buys after parabolic moves.

- Leaving large balances on unregulated exchanges.

- Overleveraging, borrowed positions are fragile in crashes.

- Ignoring basic project due diligence (team, audits, adoption).

The road ahead: realistic expectations

Crypto has matured: institutional services, custody products, and regulatory frameworks are developing. But volatility, failed projects and policy shocks remain. A balanced approach mixes curiosity with caution: focus on fundamentals, secure custody, small allocations, and continual learning.

.