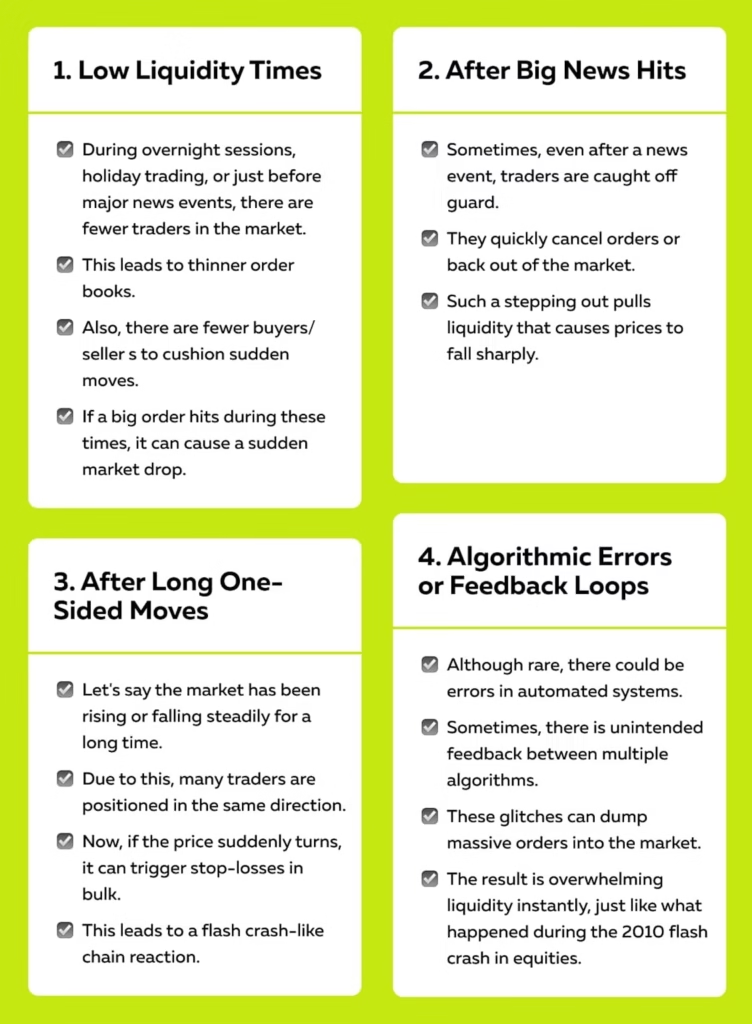

Four key causes of flash crashes in markets including liquidity issues, big news reactions, one sided moves, and algorithmic errors

Something extraordinary is happening in cryptocurrency markets that defies conventional market logic. While SEC Chairman Paul Atkins stands at the Federal Reserve Bank of Philadelphia unveiling “Project Crypto”, the most comprehensive regulatory clarity initiative in crypto history, Bitcoin flash crashes to $80,500 on Friday morning. As the CFTC proposes expanded spot crypto jurisdiction and banking regulators rescind restrictive guidance, institutional investors yank $903 million from Bitcoin ETFs in a single day. The disconnect isn’t subtle. It’s screaming.

This represents a fundamental puzzle that reveals more about market mechanics than market sentiment. Understanding why Bitcoin trades at seven-month lows precisely when regulatory tailwinds strengthen offers critical insights into how modern markets actually function and where genuine opportunity hides beneath apparent crisis.

The Flash Crash Nobody Expected

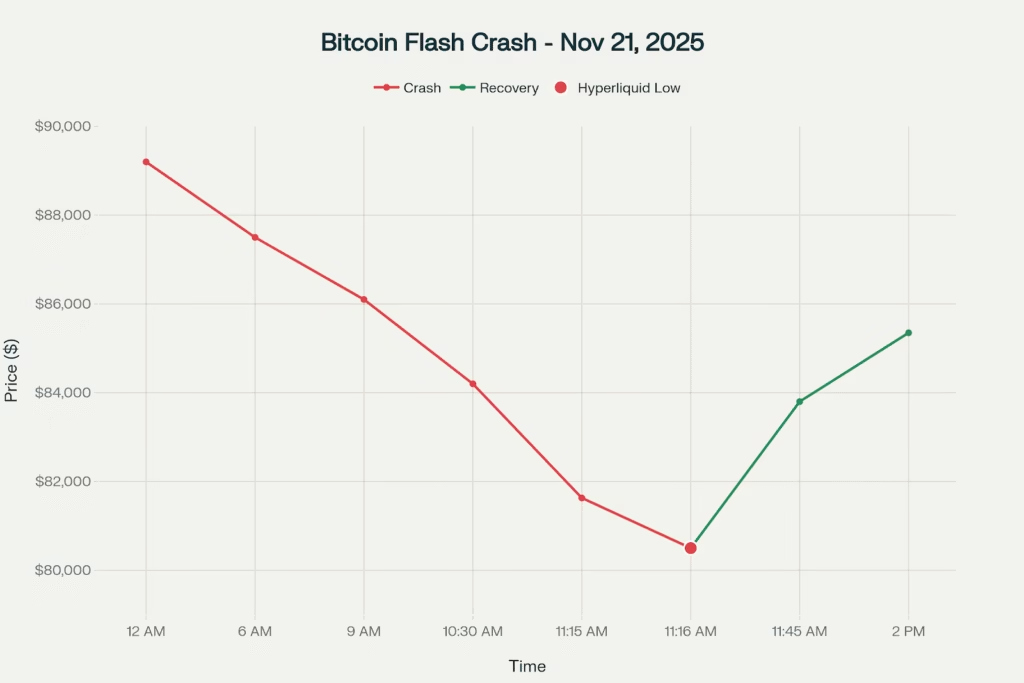

At 11:16 AM UTC Friday, Bitcoin’s price on decentralized exchange Hyperliquid plunged to $80,500 a violent $8,700 drop from morning levels that lasted under 60 seconds. Spot markets registered a low of $81,629 before recovering to $85,350 by afternoon trading, but the damage was done. Over $2.21 billion in leveraged positions evaporated across 409,227 traders in 24 hours, with the first four hours alone accounting for $1.9 billion in forced liquidations.

The mechanics tell the real story. Market depth, the volume of buy and sell orders at various price levels never recovered from October’s initial crash. Order books remain 40% thinner than pre-crash levels, meaning relatively modest sell orders create outsized price movements. When a large liquidation hits these thin books, prices don’t decline gradually. They gap violently.

Hyperliquid’s flash crash resulted from concentrated long positions getting margin-called simultaneously. The decentralized perpetuals exchange, which has processed over $10 billion in derivatives volume in 2025, saw its order book temporarily exhaust all bids above $80,500. For precisely one minute, no buyers existed at higher prices. The moment fresh bids appeared, price snapped back a textbook liquidity vacuum.

Bitcoin flash crashes to $80,500 on thin liquidity before recovering to $85,350 as $2.21B in leveraged positions liquidate

This pattern repeats across crypto infrastructure. Open interest in Bitcoin perpetual futures has collapsed 35% from October’s $94 billion peak to current $61 billion levels. Trading volume sits at its lowest since June. The market isn’t functioning with normal liquidity buffers. It’s operating in crisis mode where small triggers create cascade effects.

The Institutional Exodus Intensifies

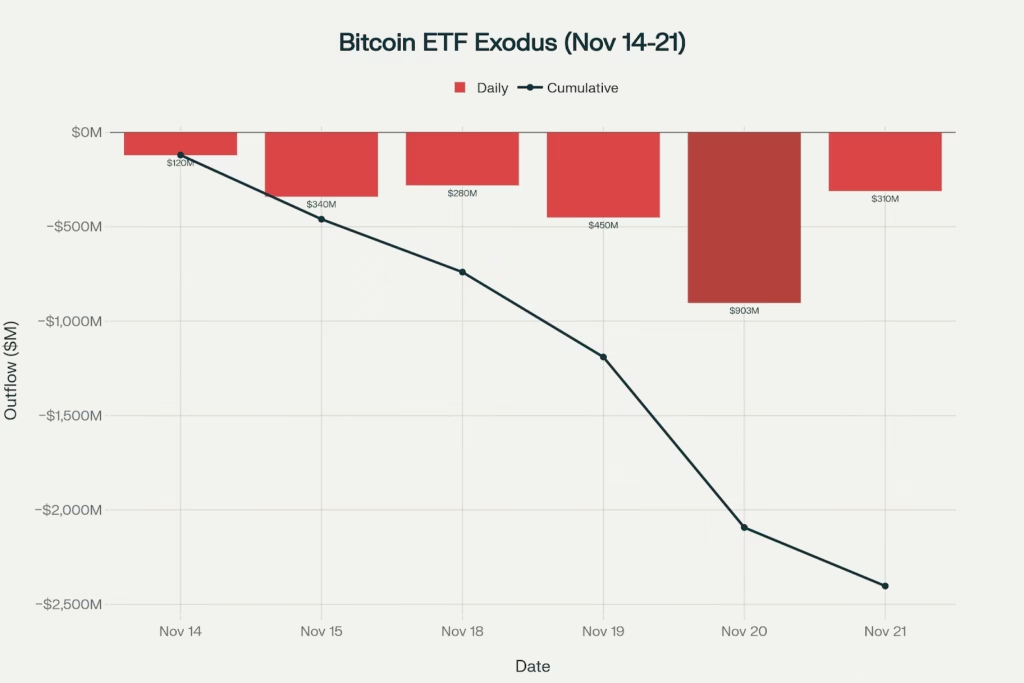

Thursday’s $903 million ETF outflow represented the second-largest single-day redemption since Bitcoin ETFs launched in January 2024. Combined with Wednesday’s $450 million exit and earlier week outflows, institutional investors have extracted $2.4 billion from crypto ETFs in six trading days. BlackRock’s IBIT, Fidelity’s FBTC, and Grayscale’s GBTC, the three largest Bitcoin funds are hemorrhaging assets despite Bitcoin trading 32% below all-time highs.

Bitcoin ETFs hemorrhage $2.4B in 6 trading days with Thursday’s $903M outflow marking 2nd-worst redemption day ever

What makes this exodus remarkable is its context. Professional allocators typically “buy the dip” when assets correct 20-30% from peaks. The fact they’re doing the opposite, accelerating selling as prices fall signals something deeper than normal profit-taking or portfolio rebalancing. It suggests genuine concern about crypto’s near-term trajectory that transcends normal volatility tolerance.

Market maker Keyrock notes that traders remain “hesitant to re-enter the market in size,” with activity “far below recent highs”. This isn’t retail panic selling. It’s professional withdrawal from a market they perceive as structurally impaired. The distinction matters enormously because retail capitulation often marks bottoms, while institutional retreat can persist for months.

Regulatory Victory Nobody’s Celebrating

Here’s where the paradox deepens. On November 12, SEC Chairman Atkins delivered the most pro-crypto regulatory speech from an SEC chair in history. “Project Crypto” promises to replace “regulation by enforcement” with formal guidance establishing four clear asset classification buckets grounded in the Howey test. The SEC plans tailored exemption regimes specifically for crypto assets, cross agency coordination with the CFTC, and explicit fraud enforcement while ending ambiguous selective enforcement.

This isn’t incremental progress. It’s transformational. For five years, crypto companies operated in regulatory purgatory, unsure which tokens qualified as securities and risking enforcement action for good-faith business decisions. Project Crypto ends that era. It establishes “fairness, predictability, and innovation” as guiding principles while maintaining investor protection..

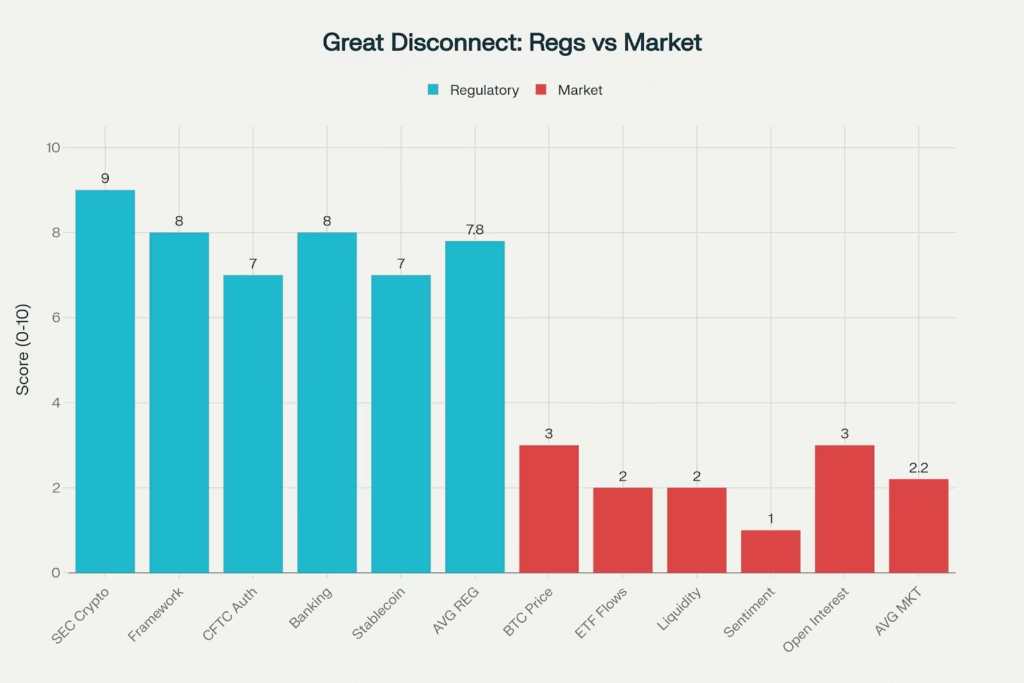

Massive disconnect emerges as regulatory clarity scores 7.8/10 while market health collapses to 2.2/10 amid liquidity crisis

Simultaneously, the CFTC proposed expanding its jurisdiction to include non-security spot crypto markets on something Acting Chair Rostin Behnam advocated since 2022. The Federal Reserve rescinded restrictive banking guidance that had effectively frozen banks out of crypto custody and services. Stablecoin guidance clarified that dollar-backed coins don’t constitute securities requiring registration.lw

In any rational market, these developments would trigger rallies. Regulatory clarity typically reduces risk premiums, attracting institutional capital. Instead, Bitcoin is down 32.5% from its ATH reached just weeks after these announcements. The regulatory environment has never been better. The market has never been worse.

The Real Driver: Liquidity Desert

The answer lies not in sentiment or fundamentals but in market structure itself. Cryptocurrency markets currently face a liquidity crisis that makes normal price discovery impossible. When Federal Reserve officials signal rates will stay higher longer than expected, risk assets face headwinds. But crypto’s response,violent crashes amplified by thin order books reveals something more fundamental.

Modern crypto markets depend on perpetual futures leverage to provide liquidity depth. When Bitcoin traded at $126,000 in early November, open interest exceeded $94 billion. That capital provided cushion depth in order books that absorbed sells without dramatic price impacts. Today’s $61 billion open interest represents a 35% contraction. The cushion has evaporated.

This creates a self-reinforcing cycle. Thin liquidity enables flash crashes. Flash crashes trigger margin calls and forced selling. Forced selling thins liquidity further. Repeat until something breaks or external capital arrives to stabilize markets. We’re currently in the middle innings of this cycle, not the end.

Friday’s jobs data provided the trigger but not the cause. September unemployment hit 4.4% higher than expected while October data remains missing due to the government shutdown. This information vacuum forces conservative positioning. Traders can’t model Fed policy without employment trends. Unable to model policy, they reduce risk. Reduced risk means less liquidity. Less liquidity amplifies volatility.

The tech sector selloff compounds the problem. The Nasdaq has erased $1.5 trillion from its intraday high as AI bubble concerns resurface. Bitcoin’s 0.85 correlation with the Nasdaq means tech weakness mechanically drives crypto weakness regardless of crypto-specific fundamentals. When Nvidia, Microsoft, and Amazon sell off as they did Thursday, Bitcoin follows purely through portfolio correlation mathematics.

What Friday’s Action Actually Signals

Flash crashes in thin markets don’t predict future direction, they reveal current structure. Friday’s violent swings tell us:

Markets are structurally fragile. Normal selling pressure creates abnormal price impacts. This continues until either liquidity returns organically or prices fall far enough to attract contrarian capital.

Institutional positioning is defensive. The $903 million Thursday ETF outflow wasn’t panic it was deliberate portfolio de-risking ahead of uncertain macro conditions. Professional money reduces exposure in low-conviction environments.

Retail capitulation is incomplete. Despite extreme fear readings, retail hasn’t fully exited. The Fear & Greed Index sits at 11 extreme fear territory but not the sub 5 readings that marked previous cycle bottoms. More downside likely required before true capitulation.

Regulatory progress doesn’t override liquidity. No matter how positive long-term fundamentals become, short-term price action depends on who’s bidding and selling today. Currently, sellers overwhelm buyers despite improving regulatory landscape.

The MicroStrategy Question

Beneath Friday’s selling lies a concerning possibility few want to discuss openly: Could MicroStrategy face forced selling? The company holds over 641,000 BTC acquired at an average cost basis near $49,000. With Bitcoin at $85,000, they’re comfortably profitable. But MicroStrategy finances its Bitcoin purchases partly through convertible debt and equity raises.

As Bitcoin falls, MicroStrategy stock (MSTR) falls harder it’s dropped 35% year-to-date. Lower stock prices make future equity raises more dilutive. If Bitcoin continues declining and MSTR stock follows, the company’s ability to raise capital for further Bitcoin purchases diminishes. In extreme scenarios, debt covenants could theoretically force asset sales.

Analysts raised this concern following Tuesday’s Bitcoin slide, noting “questions about margin pressures on large leveraged holders such as MicroStrategy”. The company has denied any forced selling pressure, but the market clearly fears this possibility. MSTR’s 5% Friday decline occurred while Bitcoin only fell 4.5%, suggesting investors price in additional risks beyond direct Bitcoin exposure.

If MicroStrategy were forced to sell even a fraction of its holdings, say 50,000 BTC into today’s thin markets, the impact would be catastrophic. That’s why every $5,000 Bitcoin decline generates fresh speculation about MSTR’s position. The company has become systemically important to Bitcoin’s price stability in ways that create asymmetric downside risk.

Where Real Opportunity Might Exist

Contrarians look at Friday’s chaos and see not disaster but dislocation—prices disconnected from fundamentals. The regulatory environment offers the clearest pathway to institutional adoption in crypto history. Bitcoin trades at seven-month lows despite these tailwinds. If markets stabilize and liquidity returns, the rerating could be substantial.

Historical patterns support this view cautiously. Previous liquidity crises (March 2020 COVID crash, June 2022 Terra/Luna collapse, November 2022 FTX implosion) all preceded powerful rallies once forced selling completed. The key question: Has forced selling completed?

Probably not yet. Several indicators suggest more downside remains possible:

- ETF outflows continue accelerating rather than slowing

- Open interest keeps declining rather than stabilizing

- Retail sentiment hasn’t reached true capitulation extremes

- MicroStrategy concerns create overhang on large holder confidence

- Macro uncertainty (Fed policy, tech sector) persists

Prudent positioning means waiting for these indicators to reverse before aggressive accumulation. The best crypto opportunities materialize after,not during the liquidity crises.

What Friday Means for Your Portfolio

For Bitcoin holders, Friday’s action changes nothing fundamental and everything tactical. The regulatory clarity story remains intact. Bitcoin’s scarcity narrative strengthens as ETF outflows represent profit-taking from institutional holders who bought lower, not existential rejection of the asset class. Long term conviction can remain high while short-term caution increases.

For traders, current markets punish leverage brutally. The 40% thinner order books mean stop losses get sliced through routinely. Position sizing must account for 10-15% daily swings becoming normal rather than exceptional.

For observers waiting to enter crypto, Friday demonstrates why timing matters. Buying the “dip” at $95,000 two weeks ago resulted in 10% immediate losses. Waiting for forced selling to complete signaled by ETF outflow stabilization and open interest bottoming offers higher probability entries.

The fascinating element is how disconnected price action has become from fundamental developments. Crypto has never had better regulatory tailwinds, never had more institutional infrastructure, never had clearer pathways to mainstream adoption. Yet it trades at multi month lows.

This disconnect won’t persist indefinitely. Either fundamentals pull prices higher once liquidity returns, or prices remain depressed long enough that fundamental optimism proves misguided. The next 4-6 weeks likely resolve which scenario plays out, as Fed policy clarity emerges and year-end institutional positioning concludes.

Markets reward those who distinguish signal from noise. Friday’s flash crash was noisy but temporary. The liquidity crisis enabling it is signal, structural and ongoing. The regulatory progress underlying it is signal transformational and permanent. Successfully navigating crypto markets requires recognizing which is which.

Friday Market Crisis (November 21, 2025):

- Bitcoin: $85,350 (-4.53% daily), seven-month low after flash crash to $80,500

- Ethereum: $2,777 (-9.12% daily), four-month low, severe altcoin weakness

- Liquidations: $2.21B wiped out across 409,227 traders in 24 hours

- ETF Outflows: $903M Thursday (2nd-worst ever), $2.4B in 6 days

- Market Cap: Below $2.8T, lost $120B in 24 hours

- Sentiment: Extreme fear (11 index), near cycle lows

- Disconnect: Regulatory clarity (7.8/10) vs market health (2.2/10)